Bitcoin is a great cryptocurrency in some ways, but how many checks does a Bitcoin user have to ensure before he/she is able to guarantee his/her anonymity?

Why not have a cryptocurrency that ensures total anonymity to its users?

Some of you might be thinking that having total anonymity is only required for criminals, but that’s not true.

in this data-centric world, I believe financial transaction data should be the most secure data there is.

here is an example:

Let’s say you stopped by an adult store to purchase something with your credit card. Here, your credit card leaves a digital trail within the merchant’s system.

Let’s suppose the merchant’s billing server or your payment processor got hacked. Now, your data is publicly available on the internet.

Who knows what kind of repercussions this could have… Maybe it compromises your relationship, maybe it compromises your career, or maybe it leads to public embarrassment. The point is, your spending habits are now public knowledge.

But we humans, in the 21st century, are mostly oblivious to the fact that this kind of situation doesn’t need to happen.

luckily We have cryptocurrencies that work upon ensuring complete anonymity of transactions. one of them is Zcash.

What is Zcash?

Zcash is a peer to peer (P2P) cryptocurrency like Bitcoin. But unlike Bitcoin, its sole priority is to focus on private, anonymous, and fungible transactions that Bitcoin can’t-do.

Zcash was forked out of Bitcoin and launched in October 2016, and it was previously known as Zerocoin. It is based on a special cryptographic protocol that shields a sender’s information, a receiver’s information, and the amount transacted between the two parties.

Zcash’s open cryptocurrency project uses a zk-SNARK protocol. This is a new cryptographic zero-knowledge proof protocol that ensures privacy, anonymity, and fungibility of Zcash coins.

However, privacy and anonymity are not implemented by default in Zcash, as it also has a transparent transaction functionality like Bitcoin.

So Zcash, by design, has optional anonymity and privacy features for users who want to use them.

How Does Zcash Work?

Zcash works on a zk-SNARK protocol. To understand this protocol more, go here.

This protocol was developed in 2014 by scientists and research cryptographers at Johns Hopkins University, Massachusetts Institute of Technology (MIT), Technion-Israel Institute of Technology, and Tel Aviv University.

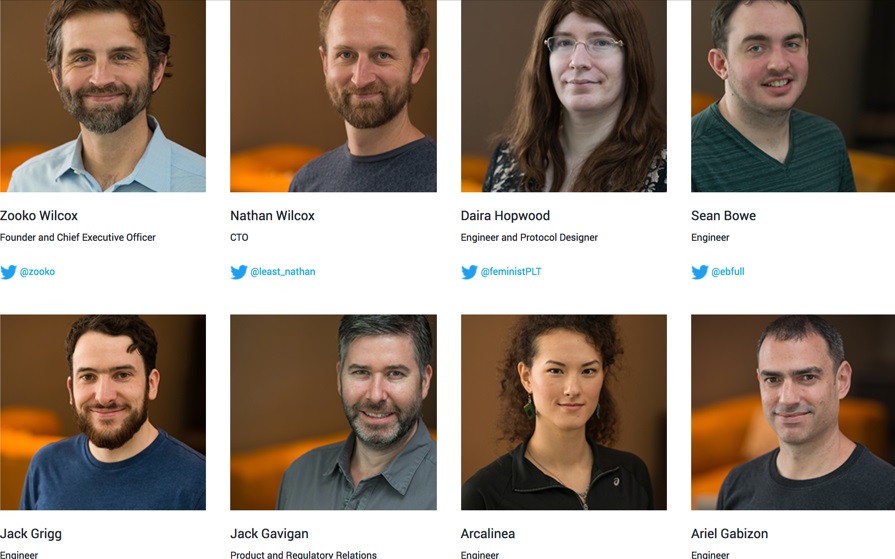

Zcash Team

The Zcash Team is a unique amalgamation of engineers, advisors, and scientists. Some of them are listed below…

Zcash is open-source, but there is an official company behind it, which is pretty unusual for an open-source project. The company is Zerocoin Electric Coin Company, or ZECC, and is lead by Zooko Wilcox.

Zooko Wilcox, the co-founder of Zcash, has found himself facing criticism over his “founder’s reward”, currently valued at over $300,000 per month.

The controversy is more striking as it only came to light because of Wilcox’s transparency in explaining Zcash’s finances at the Zcon0 conference in Montreal.

According to Wilcox’s presentation he receives 2,033 ZEC each month as part of a “founder’s reward.” At current prices this amounts to a monthly payment of over $300,000 per month, or $3.6 million per year.

Zcash Coin Supply And Distribution

Zcash (ZEC) has a total maximum supply of 21 million coins, like Bitcoin, and is mined through a POW Equihash algorithm. All 21 million are expected to be mined by 2032, and just like Bitcoin, the Zcash block mining reward is cut in half every four years.

Zcash was not pre-mined or ICO-funded like many other crypto projects; instead, it follows a unique funding and distribution approach.

Zcash started with a closed investor’s group who funded the company with $1 million to kick off its development and operations. In return, these investors are promised a 10% reward of the total supply in an incremental way over the first 4 year period.

Some the popular investors from this closed group are Barry Silbert, Erik Voorhees, Roger Ver, and Naval Ravikant.

This 10% reward of investors is called a “Founders’ Reward” which basically means that whatever amount of Zcash is mined for the first 4 years, 10% of Zcash will be incrementally distributed among these investors.

This comes down to 2.1 million being distributed to investors in the first 4 years, which can represent a kind of tax on mining.

After 4 years, the total mining reward goes to miners like in a typical proof-of-work system.

How To Buy Zcash Cryptocurrency

Zcash is an altcoin and buying altcoins directly in fiat currency is very rare.

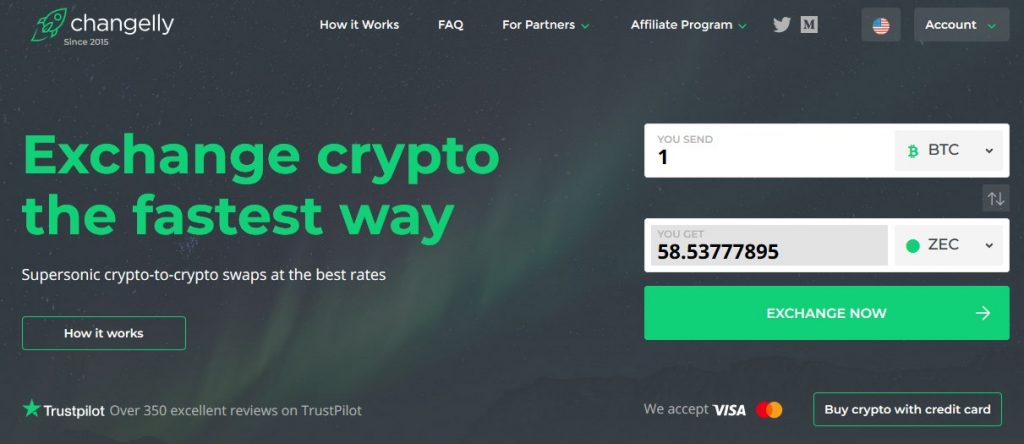

That’s why I have made this list of buying/exchanging options for Zcash which includes some easy buying options such as Changelly & ShapeShift along with advanced options such as buying from exchanges in various fiat/crypto pairs.

Buy Zcash from Changelly

Buying Zcash directly in fiat currency is difficult. But you can exchange your other coins, such as BTC, LTC, or ETH in exchange for Zcash on Changelly.

Using Changelly is very simple.

You will require the following things to buy Zcash:

- Your Zcash address where you would like to get your Zcash coins.

- Some bitcoins/altcoins to exchange for Zcash.

Head toward Changelly, and follow the steps.

Buy Zcash from Exchanges

Some of the popular Zcash exchanges are:

Binance– Supported pairs are ZEC/BTC, ZEC/ETH

CoinBase – They added Zec recently

Huobi – Supported pairs are ZEC/BTC, ZEC/USDT

Bittrex – Supported pairs are ZEC/BTC, ZEC/ETH, ZEC/USTD, ZEC/USD

Cex.io – Buy using Credit/Debit card instantly

Kraken – Supported pairs are ZEC/BTC, ZEC/USD, ZEC/EUR

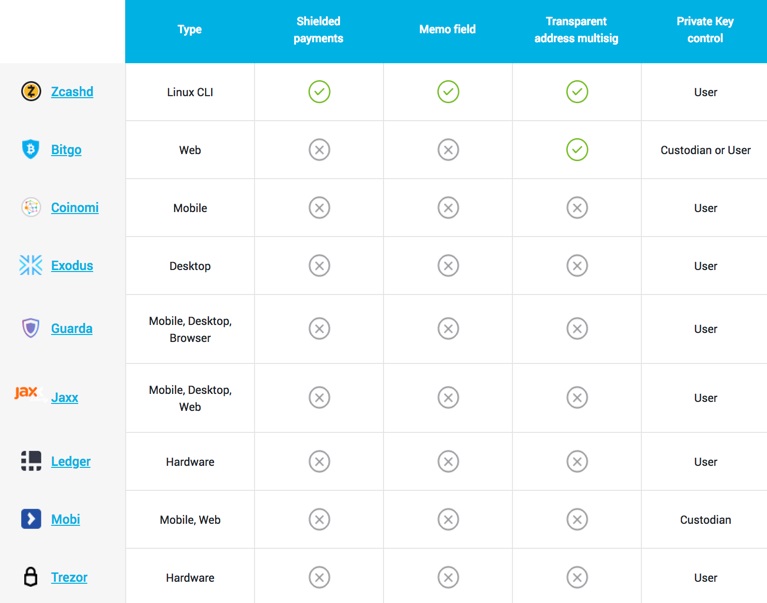

Popular Zcash Wallets

Some of the popular Zcash wallets are:

Hardware Wallets for Zcash

Hardware wallets are the best choice if you need secure storage for your Zcash. If you are an investor, a hardware wallet will probably be the easiest way to secure your Zcash.

Ledger Nano S

The Ledger Nano S is probably the most popular crypto hardware wallet at the time of writing and supports Zcash.

You should follow this guide to use your Nano S with Zcash.

It costs about $70 and is sold by Ledger, a Bitcoin security company based in France.

The Nano S supports Litecoin, Bitcoin, Ethereum and many other coins like Zcash. The device creates your private keys in its secure chip and stores your keys offline away from the internet.

The Nano S has a screen so it helps you verify and confirm all outgoing Zcash transactions, which provides additional security.

TREZOR

TREZOR is very similar to the Nano S, but is sold by Satoshi Labs. TREZOR was actually the first hardware wallet to have a screen, which provides extra security.

According to TREZOR’s official blog, it supports Zcash in its official wallet.

TREZOR will cost you $99 and ships from Europe.

Best Zcash iOS and iPhone Wallets

Jaxx

Jaxx is a multi-currency crypto wallet for iPhone and iPad. It supports Zcash although it is not open source. It should not be used for large amounts of Zcash, but is a great option for day-to-day use or accepting payments on the go. There was recently a hack where many users lost money, so please be careful.

Best Zcash Android Wallets

An app called Freewallet claims to make an Android wallet for Zcash. The wallet does not appear to be open source, though, so use at your own risk and not for any large amounts.

Zcash Paper Wallet

You can make a paper wallet for Zcash, but it is very hard to do this correctly and securely unless you really know what you are doing.

You’d need an offline, secure computer and then print out the private key to create a paper wallet.

A paper wallet can be a cheap way to create a secure wallet if you can’t afford a hardware wallet. However, again, it is hard to do right so please do some searching on Google for how to make a secure paper wallet if this is something that interests you.

you can use this online tool to create Zcash paper wallet: pwall.org/zcash/

Future of Zcash (zcash price prediction)

Here are a few things to know about Zcash…

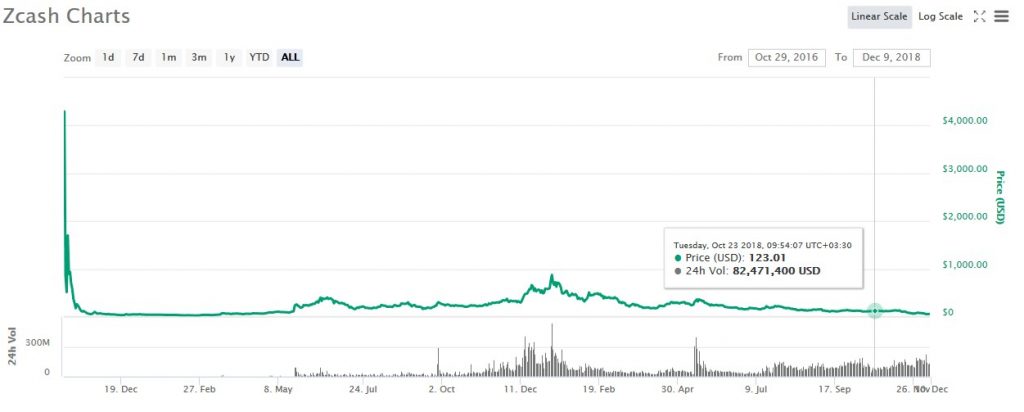

- When Zcash was launched, it was valued above $3000, but in a few weeks in January 2017, it came crashing down to $50 and is trading now under $400. But one cannot say that it’s not a good store of value because of these price drops as we all know that Bitcoin also until now have gone several times from this kind of roller coaster rides.

- You need minimum 8 GB of RAM along with several minutes to sign and send an anonymous transaction. This doesn’t really offer much value to day-to-day users. Because of this, Zcash needs to keep this anonymous feature optional. Expect a price spike when the Zcash’s dev team is able to solve this issue of user-friendly anonymous transactions.

- Zcash’s core technology, the zk-SNARK protocol, was invented in 2014 and implemented in 2016 with Zcash. It is relatively new and has yet to undergo the test of time which other privacy cryptos like Monero have undergone. But still, the later one i.e Zcash is believed to be better in tech.

- Zcash’s distribution mechanism looks like a state taxing its citizens as they are also taxing mining of Zcash for 4 years. Moreover, there is no transparency on what percentage of rewards each invested entity is receiving which raises unanswered questions.

- Zcash’s governance mechanism also raises several questions, because despite being open-source, they have a company that looks after pretty much everything. Their trusted setup of individuals takes care of Zcash security, backdoor allegations, and insane inflation rates. That just doesn’t make much sense for the decentralized cryptocurrency.

Certainly, if some of the above-listed issues are taken care and fixed then Zcash will have even more fruitful future because it is already using Bitcoin’s core protocol which has undergone the test of the time and also has superior privacy features on built on top of it.

On the other hand for a minute if we ignore some of these allegations of a backdoor and trusted setup then certainly Zcash is a good thing to invest in because since march onwards this year it has given an ROI of more than 1400% which is incredible.

But if you are investing then be ready for a roller coaster ride because historical charts suggest the same as shown below.

Also, investors who were able to time the market and news have been able to make good profits out of this investment when the price dropped had dropped to its all-time low of $26.

And some were even able to reap profits when Zcash after lingering around for 200$ spiked almost 100% in the last few weeks.

Sapling is a network upgrade for Zcash that introduces significant efficiency improvements for shielded transactions that will pave the way for broad mobile, exchange and vendor adoption of Zcash shielded addresses.

Concepts in Zcash (Wiki)

1 – You have one or more payment addresses. If you don’t give a payment address to someone, they can’t pay you.

2 – You have one or more spending keys. There’s a 1:1 mapping between spending keys and payment addresses. Knowledge of the spending key is necessary and sufficient to spend the ZECs that are sent to its payment address. Knowledge of the spending key allows you to derive its payment address.

3 – You have one or more viewing keys. If you have the viewing key, you can see the following information:

for all incoming transactions: amount, timestamp, memo

If you don’t have the viewing key, you can’t see any of that information. There’s a 1:1 mapping between spending keys and viewing keys. Knowledge of the spending key allows you to derive its viewing key. Giving someone a viewing key does not provide them with the payment address, or vice versa.

Note that we cannot enforce that this information is a complete record of transactions: coins can be sent out-of-band, and output ciphertexts may not be correctly encrypted to the public key corresponding to the sending address’s viewing key.

4 – All the information that anyone can see (using viewing keys) is authenticated, immutable, and undeletable — you can never be tricked into seeing something that everyone else wouldn’t also see if they looked at the blockchain with a sufficient viewing key.

For example, about the memo field: even the holder of the spending key, who got to choose the spending key and then got to choose the cleartext of the memo field and to produce the encrypted transaction and all of its coinflips, still can’t give two different people viewing keys (whether the same or different viewing keys) such that those two people, starting with the same encrypted transaction info in the blockchain, see different cleartext when they decrypt the memo field.

5 – Your payment address is unique; if you give the same address to two different people they can recognize they both received the same address if they compare notes.

6 – If you delete both your spending key AND its viewing key off of a device then nobody can learn information about the transactions exposed by that viewing key, even if they watched the blockchain all along, sniffed your network connection all along, and they subsequently steal the device on which you previously had your spending key and/or viewing key. (“Forward secrecy”)

7 – Spending keys and viewing keys are short and unchanging strings. You can backup and restore them, and you get all of what you would expect by restoring a back-up — all of the things that you had access to before, you have access to again after you restore from backup, provided your node is up-to-date with the blockchain.

For example, if you backup a spending key, and then receive and send Zcash with it, and then drop your device in a mud puddle, get a new device, let your new device sync with the blockchain, and then put your spending key back in (i.e. restore it, e.g. type it in from a slip or paper, scan it from a QR code, load it from a USB drive or whatever) then you do not lose any funds!

All of the Zcash that you ever received to that payment address and have not already spent using that spending key is now available to you to spend with that spending key.

This is important to avoid the “Stone Man Loss”

If you restore a viewing key from backup, you see all of the transaction history that the viewing key exposes.

If you restore a spending key from backup, you also automatically get its viewing key.

Zcash mining

Zcash CEO Zooko Wilcox-O’Hearn collaborated with leading cryptographers for over three years, conducting in-depth research and testing the viability of a new cryptocurrency that solved a major problem – one that is a sticking point for many users – privacy.

Most cryptocurrency transactions rely on the use of private keys, which are a string of letters and numbers that identify each user. Those addresses are attached to all transactions, which makes it possible to research users’ purchasing trends, and with enough forensic research, uncover their identities.

Zcash leverages a zero-knowledge proof concept that is known as “zk-SNARKs,” which allows users to exchange transactional information without giving up their personal identities. Zcash payments are published on the public blockchain, and users can decide to use an optional privacy feature that conceals the sender, recipient, and the amount of the transaction.

This is an exciting development for cryptocurrency users, and with Zcash generating so much attention, many want to learn more about mining but often struggle with getting started. Here is a quick guide.

Zcash Mining Basics: How Does It Work?

Zcash is a cryptocurrency that generates new coins through the mining process. Each time a block is added to the Zcash blockchain, a new ZEC is created. In fact, new blocks are created about every 2.5 minutes.

Zcash launched with a “slow-start mechanism,” which is different from many cryptocurrencies. The number of coins released into the system was much smaller in the early days of mining to mitigate the risk of the protocol having a major bug or security issue. If a problem was uncovered, the slow-start mechanism would reduce the impact. This approach impacted the first 20,000 blocks that were mined over the first month.

A “proof of work” algorithm is used, and Zcash uses the “Equihash” algorithm, which is not compatible with application-specific integrated circuit chips mining. This is a plus for new miners because cryptocurrencies that are compatible with ASIC mining make it difficult to mine using CPU or GPU hardware. The ASIC units are so powerful, it’s nearly impossible to compete with these expensive units and turn a decent profit.

Also, because the ASIC units aren’t currently used for Zcash cloud mining, you can get started relatively quickly and without a large upfront investment. Potential miners could use their existing CPUs, join a mining group, and start earning relatively soon. But let’s back up. What exactly do you need to get started mining Zcash?

Selecting the Right Hardware for Zcash mining

Mining hardware directly affects potential mining profits, so it’s important to understand all your options. Zcash uses the Equihash algorithm, which relies on high RAM requirements, so miners can’t use the ASIC setup for mining the cryptocurrency. As a result, you have two options to consider – CPUs and GPUs. Let’s briefly discuss each.

CPU equipment

The benefit of mining Zcash is that you can use your existing CPU, which you can’t do with other options, such as Bitcoin. This is one of the main differences between Zcash and bitcoin. The equipment that miners use with Bitcoin is so powerful, it would be very unprofitable to even attempt CPU mining – but this isn’t the case with Zcash. If you’re purchasing a new CPU, make sure that it has adequate cooling because units can get very hot during mining.

GPU equipment

The benefit of GPU mining is that it’s faster and more efficient than CPU mining. But it’s also a more expensive investment. When looking to purchase this type of equipment, check the hashing power of the unit (which is directly tied to how much you’ll earn).

Some miners decide to purchase a used setup, which is fine, but GPUs get hot and if the cooling isn’t working properly, it could quickly destroy your investment. As with the CPU units, ensure that all fans are working correctly upon receiving the equipment.

Purchasing an expensive “rig” that costs hundreds or even thousands of dollars isn’t necessary when mining Zcash. If you want to get started quickly, use your existing CPU and consider upgrading to a GPU later. If you’re more experienced with mining and want to maximize your profits from Zcash mining faster, you might consider purchasing a GPU right away. The potential to earn more exists with the GPU setup, but isn’t necessary if you simply want to get your feet wet, and get started mining.

Zcash Mining Reward – How Much Can You Earn?

Miners want to receive a reward, and ideally, as quickly as possible. As a result, many wonder how much you can earn with Zcash. The Zcash monetary base is the same as bitcoin, which is a total amount of coins produced of 21 million ZEC units. However, 10 percent of that reward is distributed to the stakeholders in the Zcash company, which includes the founders, investors, advisors and employees. Zcash calls this the “Founders Reward“.

For the first four years of operation, 50 ZEC will be created every 10 minutes, and 80 percent of that newly created ZEC goes to the miners while 20 percent goes to the founders. Every four years, the rate of ZEC being created will halve, similar to Bitcoin.

So how much will you earn? Currently, the reward is set at 12.5 ZEC per block. However, each four-year period (or 840,000 blocks mined) that reward is cut in half. For example, in the year 2020 the reward is expected to drop to 6.25 and in the year 2024 the reward is forecasted to drop to 3.12 and so on (until the currency reaches its cap). This will make mining more difficult over time. As with most new cryptocurrencies, those who start mining early may have an advantage when it comes to earning rewards.

Determining Profitability

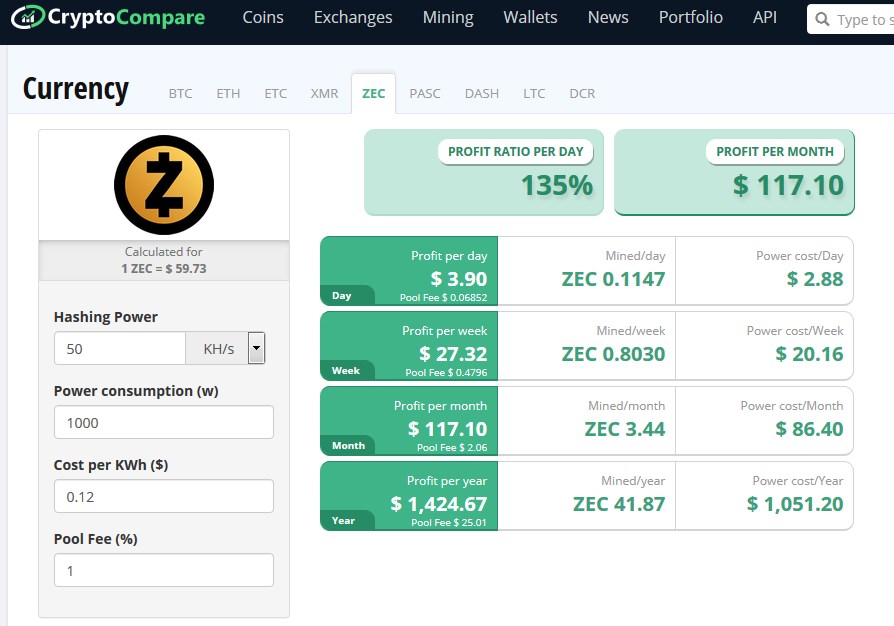

We discussed the Zcash reward, but let’s put things in perspective and explore the potential reward. How much can you earn mining?

The amount of your reward will depend on a variety of factors, including the equipment purchased, electricity cost in your area, and whether you belong to a mining pool or mine alone. But regardless, you can figure out your unique situation by using a profit calculator.

For example, this calculator allows you to input the hashing power, power consumption and cost per kW/h to determine your profit ratio per day and per month. Prior to purchasing equipment, you can use this type of calculator to determine whether the initial investment is worth the potential profit.

For example, you might already have a CPU, but determine that investing in a GPU allows you to significantly increase your profit potential. As a result, that upfront investment is worth the cost.

Should I store zcash in Coinbase?

Unlike most exchanges, Coinbase is insured (How is Coinbase insured?). There are still risks (such as password theft). There is also some risk (I would think) of not getting your money in the case of a major hack, despite the insurance. Presumably this is small, but who knows.

If you do use Coinbase, I would be sure to turn on as much 2FA as possible. For instance you should enable second factor authentication with an app like Google Authenticator . An alternative is to use SMS for authentication, but this surprisingly turns out to be very unwise. (Hackers Have Stolen Millions Of Dollars In Bitcoin — Using Only Phone Numbers).

If you have a lot of holdings, you might also look into a Coinbase vault.

we suggest Ledger Nano s wallet, because it is simple to use, holds a variety of currencies, and is inexpensive. we consider this method to be less stressful, though you would be comfortable storing large holdings on Coinbase as well. I would not consider storing much currency on any site other than Coinbase.