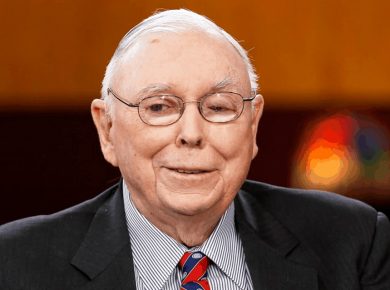

While Charlie Munger is indeed wealthy, he is not as wealthy as Warren Buffett primarily because of differences in their investment styles, personal financial decisions, and the ownership structure of Berkshire Hathaway.

Investment Styles

Warren Buffett is known for his exceptional investing prowess and the ability to identify undervalued companies with strong competitive advantages. He has consistently generated high returns for Berkshire Hathaway shareholders through well-timed investments. While Charlie Munger has also been involved in investment decisions at Berkshire Hathaway, Buffett’s track record and unique investment insights have contributed significantly to his wealth.

Ownership and Compensation

Warren Buffett had a different compensation arrangement with Berkshire Hathaway compared to Charlie Munger. Buffett acquired a significant stake in Berkshire Hathaway over the years, and his personal wealth became closely tied to the success of the company. Additionally, Buffett’s compensation included stock options and a salary structure that allowed him to accumulate significant wealth over time.

Personal Financial Decisions

Both Munger and Buffett have made personal financial decisions outside of their Berkshire Hathaway roles. While Munger has been involved in investments and served as a director on various boards, his personal financial choices might have played a role in the difference in their net worth. Buffett, for instance, has famously lived a frugal lifestyle and committed to donating a substantial portion of his wealth to philanthropic causes.

Warren Buffett’s net worth is considerably higher than Charlie Munger’s. This can be attributed to the factors mentioned above, among others.

It’s important to note that both Charlie Munger and Warren Buffett are considered highly successful and wealthy individuals, and their net worth differences do not diminish Munger’s accomplishments in any way. Their collaborative efforts at Berkshire Hathaway have led to substantial wealth creation for both themselves and their shareholders.

What made Charlie Munger rich?

Charlie Munger’s wealth is primarily the result of his successful career in business, investing, and his partnership with Warren Buffett. Several key factors contributed to his wealth:

- Partnership with Warren Buffett: One of the most significant contributors to Charlie Munger’s wealth is his long-standing partnership with Warren Buffett. Munger and Buffett co-chair Berkshire Hathaway, a multinational conglomerate holding company. Their collaboration has been crucial to the company’s success and wealth creation. Berkshire Hathaway has grown from a struggling textile manufacturer into a diversified conglomerate with holdings in various industries, including insurance, utilities, manufacturing, and more.

- Investment Expertise: Charlie Munger is known for his exceptional investment acumen. His ability to analyze companies, identify value, and make astute investment decisions has contributed significantly to his wealth. He has a deep understanding of businesses and industries, and his investment insights have led to substantial returns for Berkshire Hathaway shareholders.

- Long-Term Perspective: Munger’s investment philosophy emphasizes long-term thinking and patience. He is known for holding onto investments for extended periods, allowing them to compound over time. This approach has helped him accumulate significant wealth through capital appreciation and compounding returns.

- Compound Interest: Munger’s understanding and application of the power of compound interest have played a key role in his wealth accumulation. He has consistently advocated for investing in high-quality businesses with strong competitive advantages and holding onto them for the long term to benefit from compounding growth.

- Business Acumen: Munger has been involved in various businesses and industries beyond Berkshire Hathaway. His business acumen and strategic insights have contributed to the success of these ventures, resulting in financial gains.

- Diversification: While Berkshire Hathaway is known for its diversified portfolio of investments, Munger’s approach to diversification within the company’s holdings has helped mitigate risks and capitalize on opportunities in different sectors.

- Continuous Learning: Munger’s commitment to continuous learning and the application of various mental models to decision-making have been instrumental in his success. He draws insights from a wide range of disciplines, enabling him to make well-informed and strategic choices.

It’s important to note that Charlie Munger’s wealth is the result of a combination of factors, including his investment prowess, business ventures, collaboration with Warren Buffett, and the application of sound financial principles over the course of his career.

What is the most important “Charlie Munger’s Mental Model”?

Charlie Munger is known for his extensive use of mental models, which are cognitive frameworks that help him make better decisions and solve problems.

One of the most important and widely recognized mental models advocated by Charlie Munger is the concept of “Latticework of Mental Models.”

The “Latticework of Mental Models” refers to the idea of building a diverse range of mental models from various disciplines, such as psychology, economics, physics, biology, and more.

By integrating insights from different fields, Munger believed that individuals could develop a more comprehensive and effective approach to problem-solving and decision-making.

This mental model emphasizes the importance of multidisciplinary thinking and the ability to apply insights from one field to another.

Munger often spoke about the value of having a broad mental toolkit to analyze and understand complex situations, allowing for better-informed decisions and a deeper understanding of the world.

In essence, the “Latticework of Mental Models” encourages continuous learning, curiosity, and the ability to see connections between seemingly unrelated concepts. By developing a diverse set of mental models, individuals can enhance their critical thinking, creativity, and problem-solving skills.

While the “Latticework of Mental Models” is one of the most important concepts associated with Charlie Munger, it’s worth noting that he has discussed numerous other mental models and principles over the years, each contributing to his unique approach to decision-making and success.

Which of the “charlie munger’s Mental Model” played a vital rule in his wealth and success?

While Charlie Munger’s success is the result of a combination of factors, several of his mental models have played vital roles in shaping his approach to business, investing, and decision-making.

One of the most influential mental models that contributed to Munger’s success is the concept of “Inversion.”

Inversion

“Inversion” is a powerful problem-solving technique that involves approaching a problem by thinking about it in reverse. Instead of focusing on how to achieve a desired outcome, you consider how to avoid the undesired outcome. Munger often advises turning a problem on its head and thinking about what could go wrong, rather than just what could go right.

By using inversion, Munger encourages a more comprehensive and cautious analysis of situations. This approach helps identify potential pitfalls, risks, and mistakes that might otherwise be overlooked. By avoiding the mistakes and pitfalls, you naturally increase your chances of success.

Another essential mental model that contributed to Munger’s success is the “Circle of Competence.”

Circle of Competence

Munger emphasizes the importance of understanding your own areas of expertise and limitations. He suggests staying within your circle of competence and not venturing into areas you don’t understand well. This mental model encourages a focused and disciplined approach to decision-making, leading to more informed and successful choices.

Additionally, the “Margin of Safety” mental model has played a significant role in Munger’s investment philosophy.

Margin of Safety

This concept involves buying assets at a significant discount to their intrinsic value to provide a buffer against potential losses. It’s a cautious and value-driven approach that helps protect investments during market downturns.

While these are just a few examples, Munger’s success can be attributed to his ability to integrate and apply a wide range of mental models, including those related to psychology, economics, mathematics, and more.

His multidisciplinary approach to decision-making, along with his critical thinking and strong ethical principles, has been instrumental in his achievements over the years.

If you want to learn more about Charlie Munger’s multidisciplinary approach, download charlie munger’s mental models in PDF and MP3.

2 comments

Warren Buffett is richer than Munger because Munger contributed more in charity. Munger has chosen to give away much of his wealth over time. Buffett has elected to give away the majority of his wealth when he passes away (perhaps to grow it’s wealth and contribute more)

To simply put it, Warren has been investing for an extremely long time. he started investing at age 11, worked with Benjamin Graham at the Graham-Newman Partnership and then started his firm the Buffet Partnerships in 1956. Charlie to the contrary, studied mathematics at Michigan and dropped out at 19 years old so he could join the US army Air Corps. Then went on to study meterology at Caltech and finally moved to Harvard Law School. You see, Warren is considered better because he’s been in the game longer, compared to Chalie.