Charlie Munger: Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Systematically you get ahead, but not necessarily in fast spurts. Nevertheless, you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day. At the end of the day – if you live long enough – most people get what they deserve.

Charles “Charlie” Munger, a longtime resident of Pasadena, California, is perhaps best known as the Vice Chairman of the world’s greatest compound interest machine: Berkshire Hathaway, Inc.

Munger, one of the most successful investors ever, is said to have the best 30-second mind in the world. He goes from A to Z in one move. He sees the essence of everything before you can even finish the sentence.

How does he do it? Through observing reality and running it against his mental models. In this summary you’ll learn some of the most important models which Charlie Munger uses, which he has talked about publicly.

These mental models have helped Charlie Munger to conquer the stock market, but they are so diverse that they have applications within many other areas too. For example, they have allowed Munger to be a successful Chairman at a large hospital, and they have allowed him to overcome devastating personal losses.

The summary will cover a total of 28 of Charlie’s mental models.

Charlie Munger says he has some 100 models in his head at all times, but he also says that a few of them carry most of the freight.

you can get all 100 models here (including cards, QUOTES, MENTAL MAPS, MEMOS, CHECKLIST, CLASSIC BOOKS)

sample:

We are going to cover the most important ones in this article, which was form Charlie Munger speech on the psychology of human misjudgement and other series of interviews he did.

The models will primarily be related to investing, but also to associated subjects such as economics, entrepreneurship & career.

1. The Swiss Army Knife Approach

You need multiple models to cope with the complex world. (not just a one tool like hammer!) the man who is in need of a new thinking tool, but hasn’t yet acquired it, is already paying for it.

2. Make Friends With the Eminent Dead

More than 117 bilion people have ever walked this earth. you are not restricted to living people when picking mentors, some of the very best people to learn from, are dead.

3. Invert, Always Invert

Problems are sometimes are easier to solve if you turn them upside-down. there are 3 things is life that guaranteed will make it a misery, do drugs, be envious and show resentment. there are 3 things is life that guaranteed will make you a failure, be unreliable, learning everything yourself, giving up early and never inverting.

Charlie Munger: it is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.

4. Compounding

The value of an investment portfolio tends to grow exponentially. money is of a prolific generating nature. money can beget money and its offspring can beget more. avoid trading, management and transaction fees, and unnecessary taxes.

5. Crush Your Cherished Beliefs

If you want to become wise, you must learn the ability to unlearn. don’t hold on to old ideas. don’t be like a man with the hammer as his only tool.

you should look at yourself as a man with a toolbox, and every idea as a tool that can be added or replaced a tool. one should recognize reality even when one doesn’t like it, especially when one doesn’t like it.

6. Opportunity Costs

Resources are not limitless. whenever you choose to do anything with your time or your money, you are foregoing many other things, opportunities, that this time or money could have been used for.

there are always choices to make and saying yes to something means that you are indirectly saying no to something else.

7. Parimutuel Betting

In the investing we are looking for the equivalent of a racehorse that has a 1 chance in 2 of winning but which pays three to one. the investing game always involves considering both quality and price, and the trick is to get more quality than you pay for in price.

8. Survival of the Fittest

It’s easier to achieve success if you specialize. seek out a niche where there is little competition. in nature and in business, specialization is key. just as in an ecosystem, people who narrowly specialize can get terribly good at occupying some little niche.

9. Margin of Safety

Calculating the true value of an investment typically involves a lot of estimations and assumptions. for this reason you should only make an investment when you think that you can get it at a fair discount of its true value.

If you use a margin of safety in your investing, a whole lot can go wrong, but you will still be able to come out on top.

10. The Superpower of Incentives

Always think about what the underlying incentives in a system are, and realize that people are often looking to game them as best as they can to serve their own interests. always consider the incentives involved when you are dealing with people.

11. Independent Thinking

To avoid getting hurt by people with the wrong incentives, you must learn to use independent thinking. always fear professional advice when it is good for the advisor.

12. Simplicity

In investing the easy decisions can be just as profitable as the more complex ones are. you do not need to invest in advanced derivative contracts or companies operating at the cutting edge technology to be a successful investor.

you can cut through the complexities of our world by always focusing on the most fundamental ideas, and be certain that you get these right.

13. Technology as a Problem

Industries that are undergoing a lot of change are, by their nature, more difficult to predict, which means that technology is more of a problem than an opportunity for the long-term investor.

14. The World’s Most Intelligent Question

If you want to become wise, don’t stop asking “why” questions, just because you are an adult. within statistics, people sometimes throw out the so-called outliers, the results that you didn’t expect to get and that divert a lot from the rest of the data.

what you want to do if you want to understand reality, is probably the exact opposite of that. study the outliers and ask “why”.

15. Circle of Competence

Limit your investment decisions to those areas that you understand very well. ask yourself the following question, 10 years from now, the industry that i want to invest in, will look like and how will the firm perform compared to competitors?

16. Filters

There are a lot of thing that you can invest your time and money in them. you do not have time to consider all of them.

by using filters, you can quickly narrow down thousands of potential investment candidates to a short-list of better than average opportunities.

17. The Fat-Pitch Strategy

Patience is key in investing. you don’t get rich by going after mediocre opportunities. if you wait for the fat-pitch, you’ll need some dry power to spend when it actually does show up.

18. Because You are Worth it

The best way to get what you want from life is to deserve what you want. Jordan Peterson says “one cannot twist the fabric of reality, basically meaning that everyone will get what is coming for them sooner or later”. cutting corners is not the way to get what you want from life.

19. Probability Mindset

Probability trees and conditional probabilities are terribly important to understand, it you want to be a rational decision-maker, both in the investing and otherwise.

Charlie Munger: not knowing about probabilities is like being a one-legged man in an ass-kicking contest. you are giving away a huge advantage to everyone else.

20. The Bell Curve

Lots of things are distributed like a bell curve but not all things, so be careful when applying the elegant mathematics that comes with this normal distribution.

be especially careful when applying the bell curve to data from any system that might be self-reinforcing.

21. Physics Envy

Humans crave simplicity and elegancy. in Physics, we have beautiful equations such as Newton’s second law and Einstein’s mass-energy equivalence. these equations are exceptional findings, and they are really elegant. subjects within social science, such as economics can not easily be converted into Newtonian formulas.

22. Vaguely Right Beats Precisely Wrong

Don’t overweigh the stuff that is simple to quantify and apply statistical techniques to. they may not be the most important variable to consider, just because you can easily attach numbers to them.

This is one of the reasons why Warren Buffett allegedly never has used a computer or calculator for making his investment decisions. even if something is difficult to measure and quantify, it should probably be included in your decision-making process, if you gauge that it’s a determining variable for that decision.

23. Secondary and Tertiary Effects

It’s been said that a butterfly can flap its wings in the Amazon jungle and subsequently, a storm ravages half of Europe. in complex systems, one action will not just have a single effect; an action will oftentimes have unexpected consequences.

Munger says that it’s very common in corporate life to forgot about how competitors will react in response to a certain move. for example, you are predicting huge cost savings by investing in new machinery or a new production plant.

The return on capital in such a project may look amazing, but often only when considering your business decision in a vacuum. if competitors do something similar, prices will fall in the industry as a whole, and the returns that were projected will disappear.

24. The Cancer Surgery Formula

When doing cancer surgery, you are trying to remove what is dangerous and bad to preserve what is still healthy and vibrant underneath. a business with something glorious underneath, disguised by terrible numbers that cause cutoff points in other people’s mind, is ideal for us, if we can figure it out. some investments have a great core, but seem terrible on a first glance.

25. Scale

Ask yourself, what will the industry of the company look like 10 years from now? to remain relevant in an industry, a company that you invest in must possess a competitive advantage.

meaning that, it must do something which allows it to beat its competitors. scale is a very common way for a large company to gain a competitive advantage, but trees do not grow to the sky.

26. Limits

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. if the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge discount.

limits can be very useful to consider when comparing, measuring and weighing stuff in the real world. you’ll get an upper bound to relate to when making your calculations

27. Non-linearity

1 Amount of input doesn’t always result in 1 amount of output. the classical example of non-linearity from economics is that of marginal utility. eating two apples is not twice as satisfactory as eating just one, there’s often diminishing returns. it’s kind of silly to expect that every business everywhere in the world would have smooth and linear earnings.

28. Manage Expectations

Joy in life is arguably a result of both expectations and results. the simplest way to happiness is to reduce expectations, rather that trying to achieve the near-impossible.

29. The Iron Prescription

If you want to be successful in life you mustn’t feel sorry for yourself or feel that the world is mistreating you. Charlie Munger is a great example of having a strong character in this regard. even when Munger’s first-born son slowly passed away in incurable Leukaemia, Munger said that “you should never, when facing some unbelievable tragedy, let one tragedy increase to two or three through your failure of will.”

30. The 5 Ws

When you are trying to get someone else to do something for you, always address the 5Ws – who, what, where, when and why. why is probably the most important one here.

.

Charlie Munger 100 mental models (PDF + MP3)

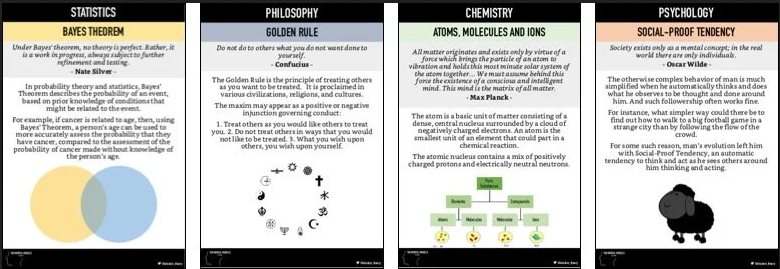

Mental models are the most significant ideas of each science: philosophy, mathematics, physics, statistics, engineering, chemistry, biology, psychology, economics and history.

You need to know and connect them.

If you want more comprehensive explanation of the Charlie Munger mental models:

>> get charlie munger’s mental models in PDF and MP3

Charlie believes that his greatest triumph in life has been learning and mastering a set of great multidisciplinary models. He thinks the ones that come from the hard sciences and engineering are the most important and reliable.

“…I went through life constantly practicing this […] multidisciplinary approach. Well, I can’t tell you what that’s done for me. It’s made life more fun, it’s made me more constructive, it’s made me more helpful to others, it’s made me enormously rich, you name it, that attitude really helps.”

– Charlie Munger

4 comments

I have been following Charlie Munger for a very long time, excellent summary of Munger’s Mental Models.

Thank you Mr Munger for all the knowledge you have shared over the years. Poor Charlie’s Almanack is one of the best books a person can read.

Charlie Munger is the most upfront and frank guy you can get without coming across as rude. I always appreciate his honesty and how he’s never scared to say it how it is regardless of how others tip toe around topics, he will always let his audience know the truth.

Charlie Munger is so amazing. People praise Warren Buffet, but they often forget the real architect of Berkshire’s investment strategy is Charlie.

A quote I like: “I didn’t want to get rich.. just wanted to be independent.. I just overshot” – Charlie Munger