This is a top 5 takeaways and summary of «100 to 1 in the Stock Market», written by «Thomas Phelps».

In this book, A Distinguished Security Analyst Tells How to Make More of Your Investment Opportunities.

For those of us that do not possess massive wealth-generating talents, such as writing extremely relatable music, leading and inspiring thousands of people in an organization or being able to take hundreds of punches to your head, investing is probably the greatest road to riches.

And if there’s one area within investing where the mathematics are truly mouth-watering, it’s when you are looking for stocks that can return 100-to-1.

$10,000 invested in a single 100-to-1 stock will turn you into a millionaire.

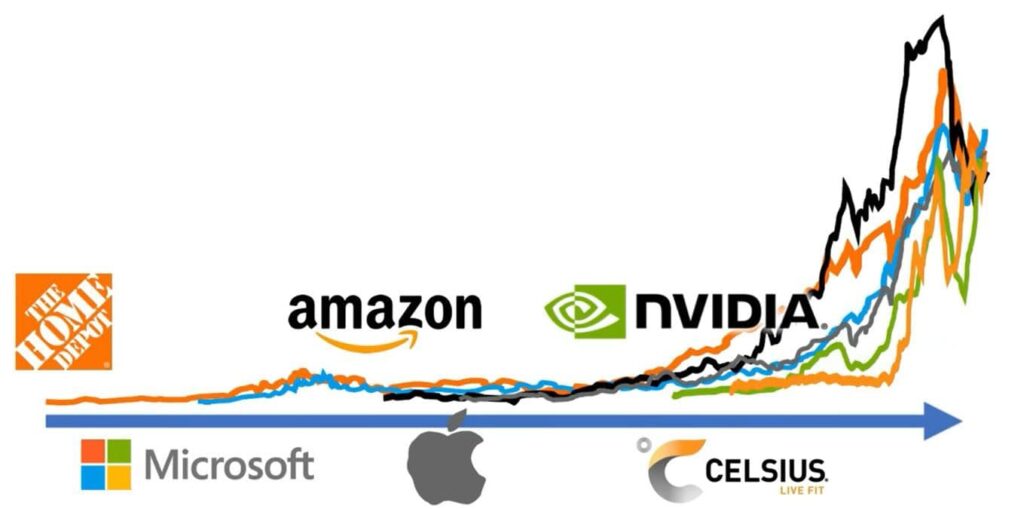

The Home Depot would have given you millionaire status since 1991. Microsoft since 1995, Amazon since 2002, Apple since 2005 and companies like NVIDIA and Celsius have managed to do it even quicker.

Except many of us may not have $10,000 laying around, and we would certainly not be willing to invest them in a single company if we did.

But the mathematics are impressive with a thousand or a few hundred dollars too.

Just consider that if you invest in 100 stocks and just one of them makes 100x, all the other 99 can go to 0 and you’d still break even.

It’s difficult to find a 100-to-1 stock, so is picking 99 companies out of 100 that all go to 0.

In fact, I know some hedge funds that would pay your weight in gold in case you can accomplish that.

The Home Depot, Microsoft, Amazon, Apple, NVIDIA and Celcius are success stories of the past though.

Peter Minuit bought the whole of Manhattan for just $24 worth of trinkets

back in the 1600s.

But of course, you and I have to operate in today’s market, so let’s try to understand how we can catch the next 100-to-1 stock.

This is a top 5 takeaways summary of 100 to 1 in the Stock Market, written by Thomas Phelps.

Takeaway 1: Four Situations.

When Thomas Phelps researched what typically characterize a company that goes up a hundredfold, he concluded that there seem to be four different situations.

“Seem to” is important here. nothing is certain in the market.

The four situations are:

- When stocks advance from the most extreme bear markets in history,

such as the Great Depression - When a company finds natural resources in a great quantity

- When a company is leveraged to the teeth but manages to survive anyways

- When a company is earning substantially more on its capital than a normal

business and has strong growth prospects

When stocks advance from the most extreme bear markets in history, such as the Great Depression

This one doesn’t seem like something that we can reliably look for.

We don’t want to be the doomsday prophet who is sitting on 100% cash hoping that

the world will break just so that he can invest his money in the stock market.

When a company finds natural resources in a great quantity

We would not want to gamble on this one.

Betting that a company will go from nothing to finding an awesome amount of gold, iron, oil, rare earth minerals, or whatever, is a little bit like playing on the lottery.

Charlie Munger likes to say:

“A mine is a hole in the ground owned by a liar.”

When a company is leveraged to the teeth but manages to survive anyways

This category may have some merit to it, but it is very tough to navigate.

Oftentimes overleveraged companies end up in bankruptcy and the shareholders are completely wiped out in favor of the debtholders.

However, if you can find a stock where the market cap of the shares is, say, one tenth of the total enterprise value, you’ll have some nice returns if the total enterprise value would, for instance, double.

Lots of diversification is recommended if you want to try this at home.

When a company is earning substantially more on its capital than a normal business and has strong growth prospects

It is this situation that we will focus on in this blog post.

All of the companies mentioned in the beginning belong here. They earned a high return on capital and were able to deploy more and more capital at similar rates over a very long time.

When we buy such companies, we have arithmetic and father time on our side.

But we need to answer two important questions.

Takeaway 2 from The book “100 to 1 in the Stock Market”: Two Seriously Important Questions

The father of value investing Benjamin Graham taught us that:

A share is a part ownership of a business. Over time, the price of a share will follow the success of the company that it represents.

And of course, business success as we know it today is producing as much earnings as possible for shareholders.

The 100-to-1 companies typically increased their earnings by something like 25-100 times over the course of a long period.

Foreseeing if a company can grow this much is no simple task, but there are two questions that, if we think we can answer them in the affirmative, will tilt the odds in our favor:

- Does the company have a durable “moat” against competition?

- Does it have great prospects for sales growth?

Does the company have a durable “moat” against competition?

The world of business is cutthroat and there’s nothing that can ruin a good company quite like an even stronger competitor.

For a business to grow its earnings 25-100 times, it must be able to fend off competitors for a long period of time, and for that, it needs what Warren Buffett likes to call a “moat”.

Something that makes it so that other people and businesses can’t easily replicate what they do and therefore steal their market share or ruin their high return on capital.

Here are a few examples of why a company possess a moat, according to Warren Buffett:

“It can be because it’s the low-cost producer in some area, it can be

because it has a natural franchise because of surface capabilities,

it could be because of its position in the consumers’ mind, it can be

because of a technological advantage …”

Does it have great prospects for sales growth?

No company can grow earnings forever without eventually selling more.

There’s only so much that can be done with a profit margin, even Pizza Pizza Royalty Corp hasn’t been able to breach 100% yet.

Sales growth can come from a variety of different sources. Perhaps the industry itself is growing and the company can ride that wave, perhaps the company can steal market share from competitors, or perhaps there are geographies that haven’t been explored yet.

A 100-to-1 stock absolutely require some such opportunity for expansion.

Takeaway 3: The Power of P/E

Usually there are two reasons why a stock increase in price. We’ve already mentioned the first one, which is growing earnings. The second one is simply the valuation of those earnings.

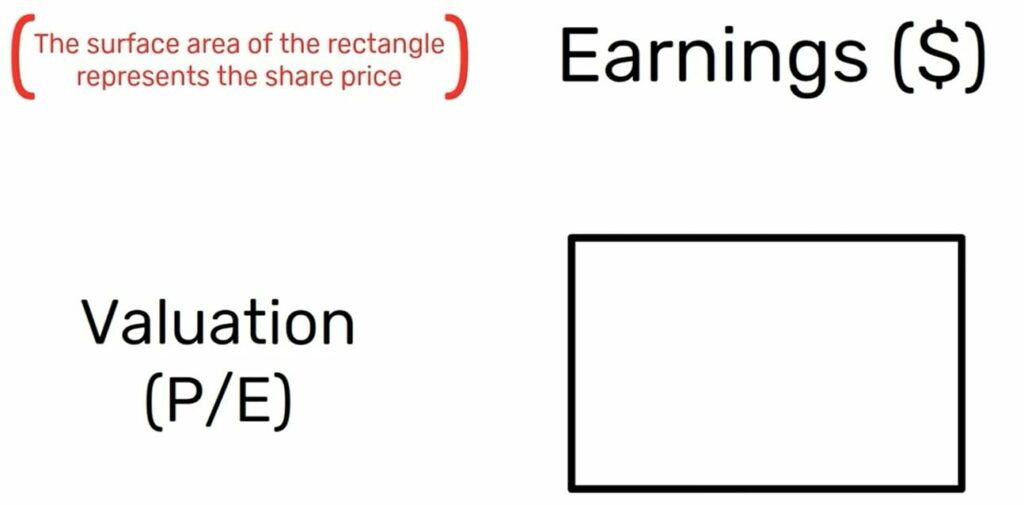

Think about the area of this rectangle as the price of a company.

On one side we have earnings, on the other side the valuation of those earnings, oftentimes expressed as P/E, or price to earnings.

The area, or the price of the stock, can double if we double the earnings, but it could also double if we double the P/E.

Here’s the point: If both earnings and the valuation can increase simultaneously, we’re getting a quadratic result, which is way more powerful than just a linear increase on either side.

Most 100-to-1 stocks increase both earnings and their valuations.

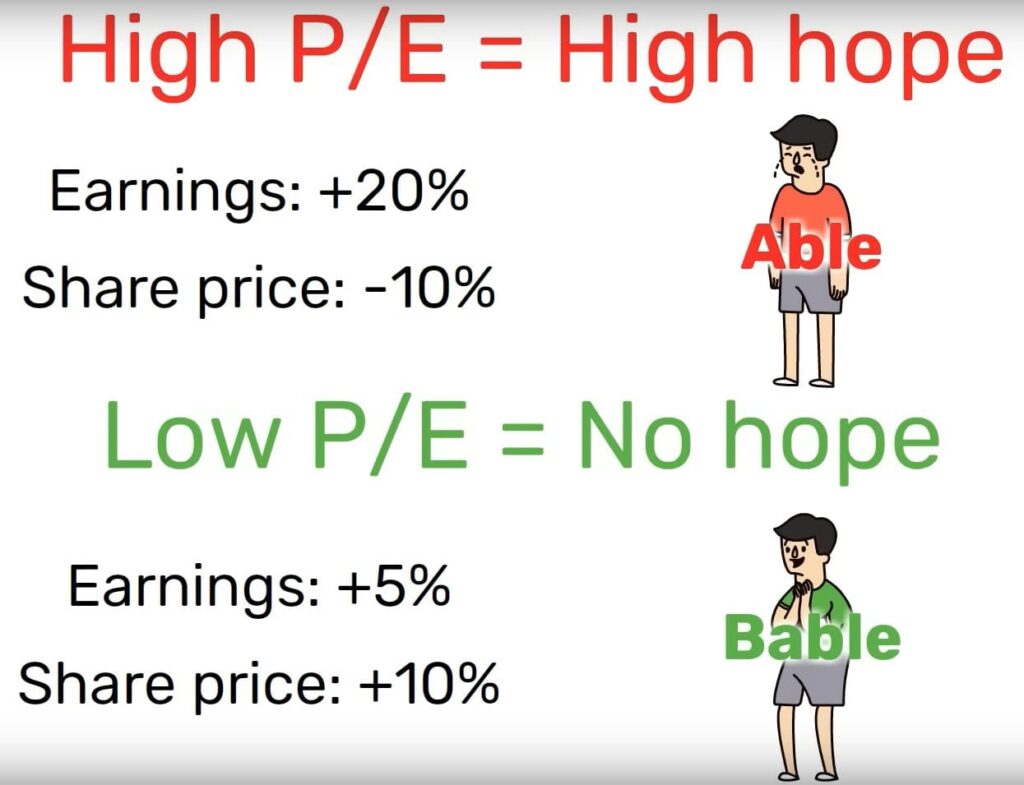

P/E is sort of a “hope thermometer”.

Some stocks score very high on the hope-scale while other fall very short.

While no doctor worth his salt would prescribe you anything based on a temperature reading alone, he’d be equally disqualified if he doesn’t at least check it.

If we want to find companies that can increase their P/E valuation, we must beware of stocks that have too much “hope” already baked into their price.

If you’ve been investing for a while, you’ve probably noticed that a company can deliver a 5% growth and the stock is up 10%, while another company delivers a 20% growth, and the stock is down 10%.

The market’s reactions to changes in earnings resemble how the two boys Able and Bable reacted to their Christmas gifts.

Bable was a happy boy when he received an RC car, because he had expected nothing.

Able was in tears when he received his RC because he had expected a Ferrari.

When you buy a company that is priced higher than the market, know that you are buying into something that must grow better than the rest of the market for you to make a nice return on your money.

Take NVIDIA as an example.

If it had a P/E of 175, which is more than 7x the S&P 500. This means that, a little bit simplified, if NVIDIA is to outperform the rest of the market, it must increase its earnings more than 7

times relative to it, and then some.

Such reasoning obviously shows a lot of confidence in NVIDIA’s future.

The opposite holds true when you buy a company at below the average. Not only must it grow slower than average, but it must also have lower prospects than the average in the unknown future, otherwise you are going to overperform.

If a stock is priced to already reflect a worst-case scenario, there’s simply no downside risk left.

Takeaway 4: The Fallacies of P/E

And we are at forth takeaway from The book “100 to 1 in the Stock Market”, Thomas Phelps

All earnings are not created equal.

Price is comparable 1 to 1, just as long as you use the same currency, but earnings can vastly differ in their “quality”.

For example: Company A and B are both selling at P/E 20.

By looking into a crystal ball, we know that both of them will double their earnings in the next 10 years.

However, company A can distribute all of its earnings in dividends every year, it doesn’t require any capital to grow its business, while company B must plow back all of its capital to accomplish the same thing.

Which one is more valuable?

Company A is more valuable because you can compound your investment by purchasing

more stocks with that yearly dividend.

Another example.

Company C and D are both selling at P/E 10. Both can distribute all their earnings in dividends.

Company C is spending quite a lot of money on R&D each year while company D isn’t.

Which one is more valuable?

Everything else equal, it will be company C because at any point in the future, it can cut its R&D to make higher earning, or it might strike gold with that research and get higher earnings from that.

NVIDIA actually gets some retribution here, it is spending almost twice as much as it is earning in R&D. Remove this and NVIDIA’s P/E ratio might look more attractive.

Capital requirements and R&D are not the only things that can make it difficult to compare the earnings of two companies in an apples-to-apples style.

A few more situations to watch out for are:

- When one company is a good citizen and the other isn’t.

- When one treats its employees well and the other doesn’t.

- When one is cyclical and the other isn’t.

Takeaway 5: Why you Have No 100-to-1 Stocks

In The book “100 to 1 in the Stock Market”, Thomas Phelps emphasis one reason why you may not have a 100-to-1 stock yet, and it’s that maybe just didn’t look for one.

In a sense, we’re like the hungry fisherman who is equipped for herring in a sea filled with large salmon.

If we are satisfied with the herring, we’re not going to get any salmon, simple as that.

Why do most people look for quick wins instead of 100-to-1 stocks? A lot of us are probably thinking that, since it oftentimes is difficult to forecast just three months ahead, say, to the next quarterly report, it must be outright impossible to see five or ten years ahead?

That is not always true, sometimes the long run is easier to predict than the short run, just like it may be easier to state who will win the game rather than who will score the first goal.

Another reason why it is hard to catch a 100-to-1 stock, or rather, to keep it, is that we oftentimes confuse activity and results.

To get 100x in a stock we must buy right and sit tight.

And that’s easier said than done.

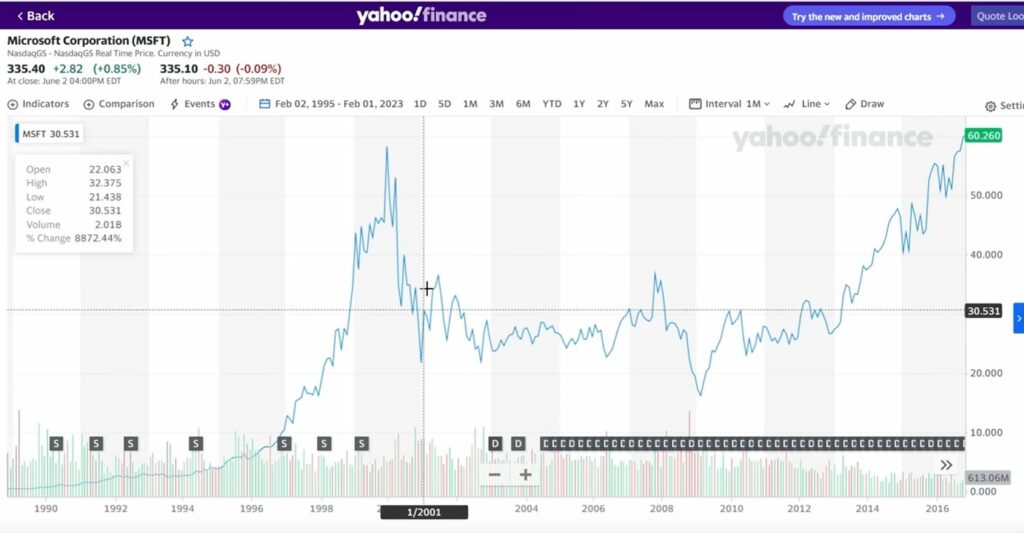

Look at this graph of Microsoft.

Getting 100x in the company has been possible, but one would have to sit still during the burst of the dotcom bubble, for example.

There are so many incentives out there that work against us in this regard too.

For example – your broker sure wants you to trade more, that’s good for their business.

- Is one of your holdings down 10%? Well, cut you losses short!

- Another one is up 10%? No one ever went broke by taking a profit!

In summary

- The situation we want to focus on is a company with abnormal growth prospects.

- For this, both a moat and possibility of sales growth is absolutely required.

- It is also very helpful if the stock can receive a higher P/E multiple than it already has.

- However, be careful with comparing the P/E of different companies in an apples-to-apples style.

- Low capital requirement, high R&D, non-cyclical businesses should have higher valuations.

- In order to catch a 100-to-1 opportunity, first, you must actually look for one, and second you must be willing to sit tight in a world that is getting more and more short-sighted.

Bonus: 5 tips from the book “100 to 1 in the Stock Market” by Thomas Phelps

The book “100 to 1 in the Stock Market” by Thomas Phelps is known for its insights into finding stocks with the potential to deliver exceptional returns. Here are five tips from the book on picking stocks with the goal of achieving a 100-to-1 return:

1 . Identify Exceptional Businesses:

- Look for companies that have the potential to become exceptional businesses. These are often characterized by unique products or services, innovative technologies, or significant market advantages. Phelps emphasizes the importance of investing in companies that can grow substantially over time.

2. Undervaluation is Key:

- Seek out stocks that are significantly undervalued compared to their intrinsic worth. Stocks that are trading at a substantial discount to their true value have the potential for significant price appreciation. Phelps advises against overpaying for stocks, even if the growth prospects seem promising.

3. Patience is a Virtue:

- Be patient and willing to hold onto your investments for the long term. Phelps suggests that true 100-to-1 stocks may take years or even decades to fully realize their potential. Avoid the temptation to sell prematurely due to short-term market fluctuations.

4. Avoid the Crowd:

- Phelps advises against following the crowd or investing in popular stocks. Instead, look for hidden gems that are overlooked by the market. He notes that the best opportunities often lie in stocks that are currently out of favor or neglected by mainstream investors.

5. Due Diligence is Critical:

- Conduct thorough research before investing in any stock. Understand the company’s financials, management team, competitive position, and growth prospects. Phelps advocates for careful analysis to ensure you are making informed investment decisions.

These tips from Thomas Phelps’ book underscore the importance of a disciplined, value-oriented, and patient approach to identifying stocks with the potential for significant long-term gains.

Thomas William Phelps Phelps’ investment philosophy encourages investors to focus on the underlying quality of the business and its valuation rather than short-term market sentiment.